Since the dawn of the Industrial Revolution, carbon dioxide levels in the earth’s atmosphere have increased by 50%. This critical statistic — combined with rising temperatures and fears of a climate crisis — has made limiting greenhouse gas emissions the top priority of world governments and industries across sectors.

Over the years, carbon capture and storage (CCS) has emerged as a technology with the potential to reduce the impact of these emissions and bring countries a step closer to achieving their stated goal of carbon neutrality by 2050.

North America has been leading the way in development, with the region hosting most of the world’s facilities. But what’s next?

Let’s take a closer look at what happened with carbon capture and storage technology in 2023 and what’s ahead.

Understanding CCS Technology’s Relevance

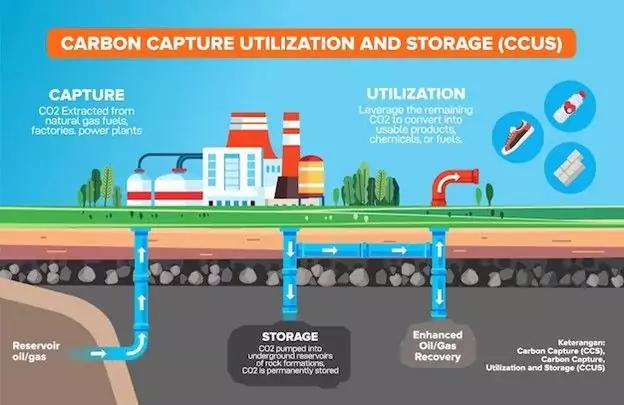

So, how does carbon capture work? Essentially, CCS facilities trap carbon dioxide released from industrial operations or directly from the atmosphere.

This carbon dioxide can then be reused on-site, compressed and sent to other industries via pipelines or stored underground in a process known as geological sequestration.

There are many benefits to this. The most obvious is, of course, that CCS facilities remove CO2 from the air and from industries that otherwise struggle to balance emission levels. A study points out that when this CO2 is injected underground, 98% of it will stay stored there for 10,000 years, with a very low chance of leakage.

At the same time, with the right engineering services, CCS facilities can be retrofitted to operate out of most existing industrial plants.

The carbon captured can be used to offset emissions in industries that otherwise struggle to meet net-zero goals. It could also be a potential source of income, with some facilities selling stored CO2 to enable enhanced oil recovery.

Alternatively, it can go into the production of low-carbon hydrogen, which can be used to decarbonize more industries.

Given these benefits, it’s no wonder that the technology has been gaining momentum.

The International Energy Agency estimates that there are currently over 500 facilities in various stages of development within the borders of its 31 member countries. These regions account for 75% of the world’s total carbon emissions.

Most of the facilities, both planned and currently operational, are in North America.

2023: a Big Year for CCS in North America

According to BTU Analytics, five CCS facilities are in the early development stage in the U.S. and Canada in 2023.

Three new projects were also announced in the two countries, including a significant 1,850,000-ton-per-year capacity facility at a proposed ammonia plant between Japanese conglomerate Marubeni and Canadian midstream operator Pembina.

The region has already been leading the way in CCS, with the United States home to almost half of the world’s facilities. Some of these facilities were opened as far back as the 1970s and ’80s. Just 10 of the U.S.’s operating facilities as of 2020 captured 25 Gigatons of CO2, which was two-thirds of the global capacity.

Fast forward to 2023, and the region is seriously ramping its efforts. North America has 123 commercial carbon capture and storage projects. A little over 20 are operational, while 101 are in the construction and development stage. The EU, by comparison, has four operational facilities, and the Asia-Pacific region has nine.

Japanese and European firms are especially interested in investing and partnering with several of the new projects announced in 2023.

Much of this push has come from changes made to Section 45Q — the section of the Internal Revenue Code that outlines a tax credit for carbon sequestration.

The 2022 Inflation Reduction Act has improved incentives for CCS facilities.

The act offers up to $85 per ton of CO2 permanently stored and $60 per ton for other industrial uses. For CO2 captured directly from the atmosphere, these credits go up to $180 per ton for stored CO2 and $130 per ton used for industrial purposes.

These credits come with a change in capacity requirements for eligible projects and a 7-year extension to qualify for the credit, promoting the construction of further CCS facilities until January 2033.

The two regions particularly benefiting from this boom are the Midwest and the Gulf Coast, which account for 35% of the global capacity. BTU Analytics identifies three reasons for this.

- Several existing industries that can be turned into CCS energy facilities

- The region’s potential for enhanced oil recovery and geological storage

- Higher premiums for low-carbon products.

Piping design engineers are also currently in the process of building three proposed CO2 pipelines to connect facilities to a central storage facility.

Upcoming CCS Projects in North America

Given all these factors, more planned carbon capture and storage facilities are popping up across the U.S. and Canada. Some of the major updates include:

- A Direct Air Capture facility in Texas that will be operational by 2024. The project is a collaboration between a subsidiary of Occidental Low Carbon Ventures and Carbon Engineering Ltd

- Air Products is investing $4.5 billion to create the world’s largest carbon capture and storage facility at a new blue hydrogen plant in Texas

- The renewable energy company Aemetis has purchased 24 acres of a former military base in California to develop a CCS injection well

- Canadian midstream operator Pembina has partnered with Japanese conglomerate Marubeni to develop a blue ammonia plant in Alberta

- Also in Alberta, Moraine Initiatives LTD plans to build a natural gas plant with an integrated carbon capture facility

- ExxonMobil and Mitsubishi Heavy Industries announced they will leverage multi-disciplinary team engineering to develop advanced CCS solutions

These are just some among a slew of projects in 2023 that will push North America to join Europe in accounting for an 11% increase in CCS deployment by 2030.

Conclusion: Decarbonizing the Future

The IEA has stated that CCS is crucial as the global community seeks ways to meet carbon neutrality goals. In fact, it places it alongside renewable electrification, bioenergy, and hydrogen as one of the four key pillars of global energy transitions.

North America’s long-standing commitment to scale up CCS technology, combined with the interest and expertise of multi-discipline engineering consultants, can go a long way in building a better future.

Planning a CCS project?

Vista Projects is an integrated engineeringThe process of integrated engineering involves multiple engineering disciplines working in conjunction with other project disciplines to e... services firm that can assist with your carbon capture and storage projects. With offices in Calgary, Alberta, and Houston, Texas, and Muscat, Oman, we help clients with customized system integration and engineering consulting across all core disciplines. Contact us today!